Blog

If You Have Any Query, Please Feel Free Contact Us

"Navigating Financial Success with Professional Accounting Services"

In today's fast-paced business landscape, financial management is a critical aspect that can make or break the success of any enterprise. This is where professional accounting services play a pivot...

Streamlining Your Financial Records

Bookkeeping Services in Lahore | FARAAC

In the dynamic business environment of Lahore, maintaining accurate financial records is essential for the success and...

Why Choose faraac?

Bookkeeping Services in Multan

In the bustling city of Multan, businesses are constantly striving to maintain their competitive edge. Amid the challenges of managing operat...

Why Bookkeeping is Crucial for Your Business

Bookkeeping Services in Islamabad

As a business owner in Islamabad, managing finances can be a daunting task. Whether you run a small startup or a large enterprise, accurat...

Your Path to Financial Clarity

Bookkeeping Services in Karachi

In the bustling metropolis of Karachi, businesses of all sizes are constantly striving to maintain financial stability and growth. One of th...

Accounting Services in Multan: A Comprehensive Guide

Multan, a vibrant city known for its rich cultural heritage and economic growth, is rapidly becoming a hub for businesses and entrepreneurs. As the business landscape in Multan continu...

Comprehensive Accounting Services in Multan

Multan, a city known for its rich cultural heritage and bustling economic activities, is home to numerous businesses ranging from small startups to large cor...

Tax Services in Pakistan

Navigating the complexities of the tax system can be challenging for individuals and businesses alike. At FARAAC, we offer comprehensive tax services designed to simplify the process...

Best Tax Consultants in Multan: FARAAC Consulting

When it comes to managing taxes, finding a reliable and knowledgeable tax consultant is essential. In Multan, FARAAC Consulting stands out as the premier choice for both individuals...

Best Tax Consultants in Lahore | faraac.com

Navigating the complexities of taxation can be daunting, but with the right tax consultant by your side, you can manage your finances efficiently and stay compliant with tax regulati...

Best Tax Consultants in Islamabad

Navigating the complexities of tax regulations can be a daunting task for individuals and businesses alike. To ensure compliance and maximize benefits, seeking professional assistanc...

Best Accounting Firms in Pakistan: Why FARAAC.com Stands Out

In the dynamic and rapidly evolving business landscape of Pakistan, selecting the right accounting firm can be a game-changer for your business. From ensuring compliance with tax regul...

Best Tax Consultants in Karachi

Karachi, the financial hub of Pakistan, is home to numerous businesses and individuals seeking professional tax services. Whether you are a small business owner, an entrepreneur, or...

How to Navigate 114(1): Filing Voluntarily for a Complete Year

Filing your income tax return can be a daunting task, especially if you're doing it voluntarily for the first time. However, understanding the process and benefits of filing under sect...

The Ultimate Guide to 114(1): Filing Voluntarily for a Complete Year for Faraac

Filing taxes can be a complex and daunting task, especially for freelancers and small business owners. However, understanding and leveraging specific sections of the tax code can mak...

Common Questions and Answers About 114(1): Filing Voluntarily for a Complete Year for FARAAC

Filing taxes can be a complex task, particularly for freelancers and small business owners. Section 114(1) of the tax code, which allows for voluntary filing for a complete year, oft...

How to Navigate 114(4): Notice to File Return for a Complete Year for FARAAc

Filing returns and complying with regulatory requirements can be challenging, particularly for those involved with the Foreign Agents Registration Act (FARA). One such requirement is...

The Ultimate Guide to 114(4): Notice to File Return for a Complete Year for FARAAC

Navigating the intricate landscape of tax regulations can be a daunting task, especially when dealing with specific provisions such as the 114(4) Notice to File Return for a Complete...

Common Questions and Answers About 114(4): Notice to File Return for a Complete Year

The 114(4) Notice to File Return for a Complete Year under the Foreign Accounts Reporting and Compliance Act (FARAAC) can be a source of confusion and concern for many taxpayers. To...

How to Navigate 122(9): Notice to Amend Assessment for FARAAC

Navigating the complexities of tax law can be daunting, especially when dealing with notices from tax authorities. One such notice, the 122(9): Notice to Amend Assessment, is part of...

The Ultimate Guide to 122(9): Notice to Amend Assessment for FARAAC

Navigating tax regulations can be daunting, especially when dealing with notices from tax authorities. One such notice that can cause confusion is the 122(9): Notice to Amend Assessm...

Common Questions and Answers About Section 122(9): Notice to Amend Assessment

When it comes to tax regulations and compliance, understanding the nuances of various notices and their implications is crucial. One such notice that often raises questions is the Se...

How to Navigate 176: Tax Compliance Explained for FARAAC

Navigating the complexities of tax compliance is a critical aspect of running a business, and this holds particularly true for companies involved in the financial advisory, real estate...

The Ultimate Guide to 176: Understanding Tax Compliance for Faraac

Tax compliance can often feel like navigating a labyrinth, especially when it involves specialized sectors such as the Financial Activities Reporting Analysis Center (FARAC). This gu...

Common Questions and Answers About Form 176: Tax Compliance for Foreign Agents

Introduction

The world of tax compliance can be complex, especially for those involved in international activities. One particular area that often raises quest...

How to Navigate 177: Comprehensive Guide to Tax Notices for Faraac

Navigating tax notices can be daunting, especially when it involves complex regulations and requirements. If you're a Faraac client or interested in understanding how to handle IRS tax...

How to Become a Filer in Pakistan?

Introduction

Becoming a tax filer in Pakistan is a significant step towards fulfilling your civic responsibilities and enjoying the benefits associat...

LLC Registration in the USA from Pakistan

Introduction

The United States is a popular destination for entrepreneurs worldwide, including those from Pakistan, who are looking to establish a business presence. Register...

PTA Tax in Pakistan: Mobile Device Importation and Compliance

The Pakistan Telecommunication Authority (PTA) tax, an essential element of Pakistan's regulatory landscape, has become increasingly significant with the rise in mobile device imports. Whether you'...

Basic Concepts of Tax on Income: Understanding FBR Guidelines

Income tax is a fundamental part of any country's financial system, serving as a primary source of revenue for the government. In Pakistan, the Federal Board of Revenue (FBR) is responsible for man...

What is Bookkeeping in Accounting? A Comprehensive Guide

Bookkeeping is a fundamental aspect of accounting, essential for the financial health and management of any business. While accounting provides a broader view of a company'...

Ultimate Guide to Bookkeeping: Streamlining Your Business Finances

In the competitive landscape of modern business, maintaining accurate financial records is more than just a legal requirement—it's a strategic advantage. Bookkeepi...

Top Bookkeeping Tips for Small Businesses: Stay Organized and Compliant

Running a small business is no easy feat. From managing day-to-day operations to marketing and customer service, small business owners often wear many hats. Amidst these responsibilities, bookkeepi...

How to Choose the Right Bookkeeping Software for Your Business

In the digital age, businesses of all sizes are increasingly turning to bookkeeping software to manage their financial records efficiently. With a plethora of options avail...

Understanding Sales Tax: What Every Business Owner Needs to Know

Understanding sales tax is critical for every business owner. Whether you're just starting out or have been in the industry for years, navigating the complexities of sales tax...

How Sales Tax Affects Online Businesses

With the rise of e-commerce, sales tax has become a significant concern for online businesses. As states continue to adapt their laws to capture revenue from online sales, understanding the implica...

Sales Tax for Consumers: What You Need to Know

Sales tax is a cost that consumers encounter almost every day, yet many are unaware of how it works or why it's applied. This guide aims to clarify what sales tax is, how it affects your purchases,...

Sales Tax in the Retail Industry

The retail industry faces unique challenges when it comes to sales tax. From managing compliance across multiple locations to understanding exemptions and handling seasonal sales, retailers must na...

The Future of Sales Tax: Trends and Predictions

Sales tax is an evolving landscape, influenced by technological advancements, changing consumer behavior, and shifts in government policy. As we look to the future, businesses must be prepared for...

Sales Tax Compliance for Small Businesses

Sales tax compliance is a critical aspect of running a small business, especially in today’s complex regulatory environment. Understanding what sales tax is, and how it app...

How Sales Tax Impacts Consumer Behavior

Sales tax is more than just a financial obligation; it has a significant impact on consumer behavior and purchasing decisions. Understanding how sales tax influences consum...

Navigating Sales Tax for E-Commerce Businesses

Navigating the complexities of sales tax is one of the biggest challenges facing e-commerce businesses today. With the growth of online shopping and the evolving tax landsc...

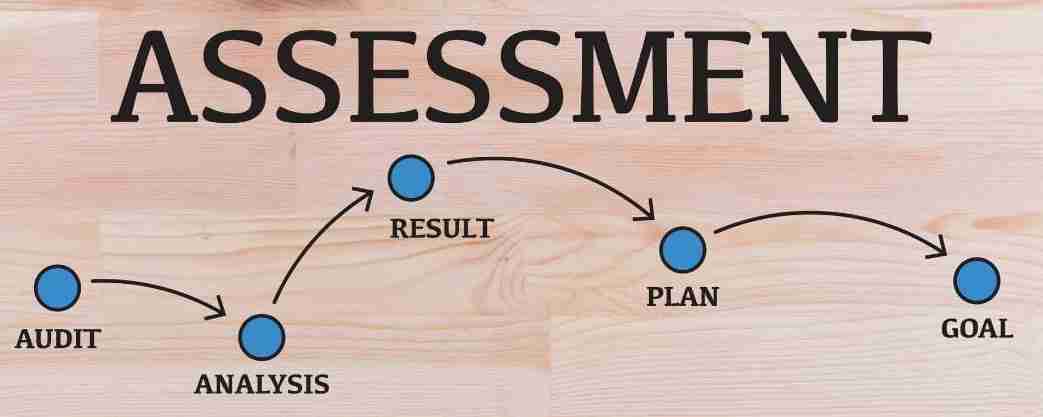

Audit Services in Pakistan

Audit services play a key role in ensuring financial accuracy, compliance, and transparency for businesses in Pakistan. These services help organiza...